The health of the financial infrastructure of an enterprise determines its survival in a hyper-competitive marketplace. A shaky financial supply chain system can have ramifications on the working capital of a business and risk its sustainability. All monetary transactions between an enterprise and its trading partners come under a financial supply chain system. These mainly include purchasing, manufacturing and selling goods and services.

In simple words, an efficient financial supply chain system delivers the cash flow required to run the shop, keep the power supply on and pay employees on time.

Financial Supply Chain Management (SCM) involves the efforts taken to ensure a holistic approach to handling financial operations, including ordering, invoicing, reconciling, and payment. The process through which trade partners acquire, produce, and sell products/services is also included here along with managing working capital and the order-to-cash cycle. The financial SCM plays a critical role in ensuring proper communication between all resources such as co-workers, supervisors, and business partners.

Businesses already using an ERP system can optimize the use of financial supply chain management solutions to manage financial flows and other relevant data in real-time. These automated applications help track discrepancies in both the procure-to-purchase and the order-to-cash cycles. For instance, with ready access to data, the finance department of an enterprise can easily view pending invoice payments for a certain set of purchase orders that are recorded in the system.

It is also possible to keep an eye on the financial transactions that can potentially lead to lower costs, thereby, opening windows for more efficient invoice processing and reduced time for customer payment cycles. Irrespective of the size of the business, it is critical to have all standard procedures in place with respect to financial management so that overall management of operations and business performance is easy.

What Does SAP FSCM Do?

SAP Financial Supply Chain Management (FSCM) enables businesses to handle all customer-related financial processes, including billing, receivables, collections, and risk assessment in the SAP ERP system. It is a collection of applications that aims to enhance visibility and control over the accounts receivable of the business. The effectiveness of the accounts payable and accounts receivable processes can be enhanced along with smart collaboration across systems and teams. Now SAP FSCM’s integrated capabilities help stakeholders make smarter decisions to increase the overall cash flows.

SAP FSCM helps gain real-time insights into the financials of the business and optimizes working capital management and receivables while lowering costs. Join hands with Gemini Consulting & Services to leverage SAP FSCM to enhance efficiency by effective administration of the receivables-related process. SAP FSCM increases the customer payments that flow in and decreases debtors. Enterprises can also use SAP FSCM to estimate working capital requirements. Contact us to know how SAP FSCM can bring down operational costs and improve the overall cash flow of your enterprise.

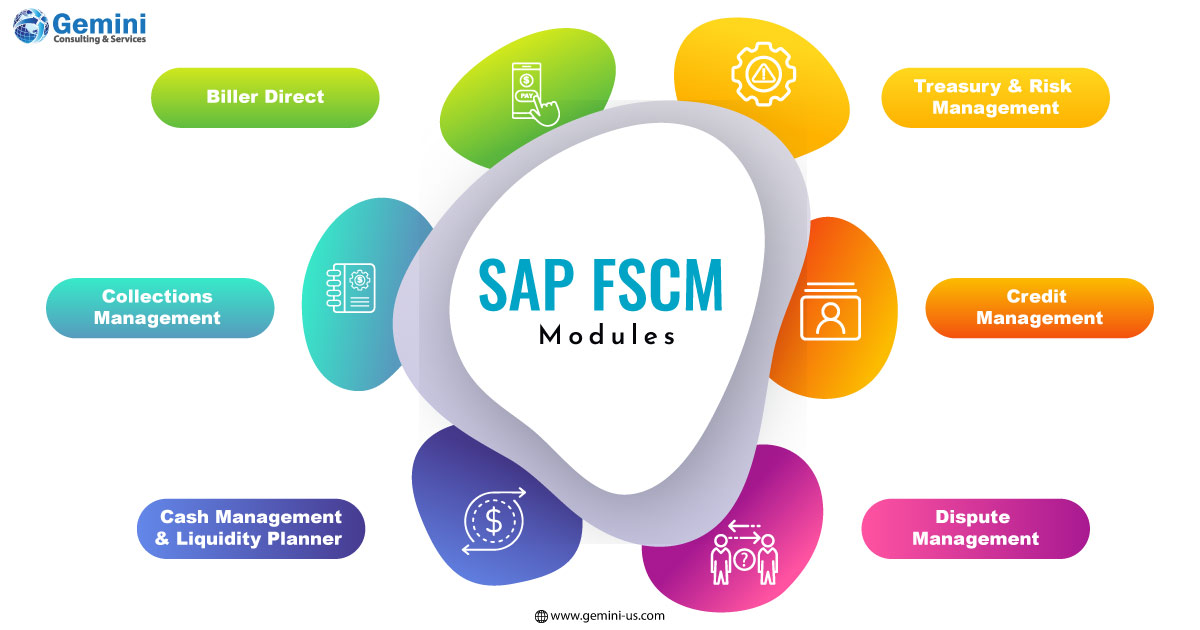

Let us quickly run through the modules now.

Biller Direct SAP

This module helps handle billing disputes, invoices, and settlement issues via a portal. This is done by enabling customers and suppliers to view invoices directly and payment information via the business site. Additionally, this module also integrates features of the FSCM system with the accounting system, thereby, managing electronic payment and settlement procedures with clients/ suppliers. The module performs the following functions.

- Helps edit payment methods.

- Handles credit cards – release, account determination, etc.

- Define partial payment and currency for release etc.

SAP Collections Management

The SAP FSCM Collections Management app can raise collection rates and productivity. This helps identify problematic accounts quickly, triggering efforts on increasing collection rates in a proactive manner.

It enables to detect delayed payments and automatically add them back for action to be taken. It gathers all relevant information from the SAP Collections Management and tries to establish contact with the customer. It also helps log customer promises to pay further which can be recorded for further monitoring. Finally, the module can log a dispute in the SAP Dispute Management Module in case of differences.

SAP Cash Management and Liquidity Planner

SAP Cash Management is used for cash flow monitoring. It estimates and ensures the availability of liquidity that is needed to handle payment obligations. The Liquidity Planner has features to enter, aggregate, adjust and evaluate planned cash flows. This helps understand actual values. This module helps handle both internal and external payment transactions, reducing the need to maintain multiple bank accounts and the volume of foreign payments that need to be made. This feature helps bring down transaction costs and allows increased visibility into account status and payment/receipt for users. This in turn makes cash and liquidity management a little less complicated.

SAP Treasury and Risk Management

This module helps manage payments, cash, risk, liquidity, and compliance and can seamlessly integrate with accounting, banking, financial reporting, and other business information systems. It is a package solution geared towards analyzing and optimizing business processes in the finance function of a business. It has sub-modules like transaction manager, market-risk analyzer, and credit-risk analyzer.

The Transaction Manager helps process related financial transactions from capturing a deal to transferring the relevant data to financial accounting. It supports both traditional treasury departments that focus on trading and asset management department. The Market Risk Analyzer offers extensive position evaluations including tools for calculating risk and return figures and includes exposure, future values, value at risk, etc. Finally, the Credit Risk Analyzer aids in measuring, analyzing, and controlling counterparty default risk.

SAP Credit Management

This module makes use of both external and internal rating data to assess the overall creditworthiness of a customer allowing for the assessment of consumer credit limits more quickly. Allow us to emphasize the fact that real-time credit data and other related financial information are key to determining the effectiveness of credit lending and the credit score system for each individual user. With this module:

- The Credit score can be updated automatically or manually customer-wise.

- There is a new functionality that can help integrate XML data from rating Agencies to create credit scores.

- Additional information such as bank records and credit reports can also be attached to help segmentation.

- Automated credit decisions and identification of risk customers.

SAP Dispute Management

This module ensures that there exists complete transparency with respect to customers’ invoicing and billing disputes. Conflicts related to receivables are easily addressed, and payment issues are detected before the issue escalates. The module helps:

- In the creation of new dispute cases and attaching the same to open items on a document.

- Assign roles to dispute cases each having different tasks such as questions, collecting information, and comments.

- Disputes can be classified by processing status and the reason.

- Actions for follow-up can be marked.

- Finally, in case of non-resolution, the case may be escalated.